This application is interactive. Be patient as it loads.

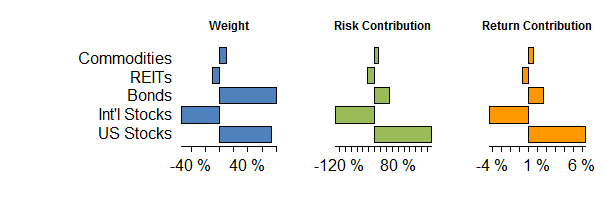

Example: Unconstrained Maximum Sharpe Ratio portfolio

Notice the Contributions to Risk are proportionate to the Contributions to Return

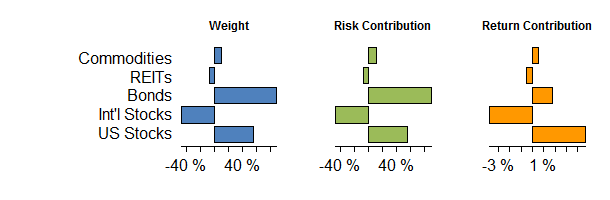

Example: Unconstrained Minimum Variance portfolio

Notice the Weights and Contributions to Risk are Equal

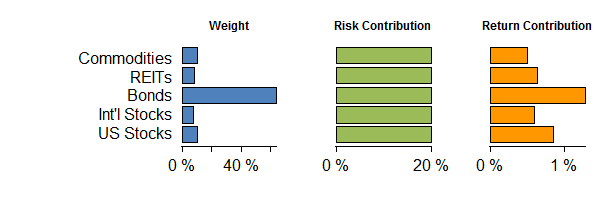

Example: Risk Parity portfolio

Contributions to Risk are equal

Assumptions

| Asset Class | Volatility | Expected_Return |

|---|---|---|

| US Stocks | 20% | 8% |

| Int’l Stocks | 25% | 8% |

| Bonds | 5% | 2% |

| REITs | 25% | 7% |

| Commodities | 25% | 5% |

Correlation matrix

| US Stocks | Int’l Stocks | Bonds | REITs | Commodities | ||

|---|---|---|---|---|---|---|

| US Stocks | 1.00 | 0.95 | 0.15 | 0.85 | 0.60 | |

| Int’l Stocks | 0.95 | 1.00 | 0.30 | 0.80 | 0.70 | |

| Bonds | 0.15 | 0.30 | 1.00 | 0.25 | 0.05 | |

| REITs | 0.85 | 0.80 | 0.25 | 1.00 | 0.45 | |

| Commodities | 0.60 | 0.70 | 0.05 | 0.45 | 1.00 |

Definitions

Weight: Asset Value divided by the greater of 1 and the sum of all Asset Values

Valuei / max(1, ![]() Valuei )

Valuei )

Risk Contribution: Product of Asset’s Weight and its covariance with the Portfolio, scaled by the Portfolio’s variance

weighti ∗ ![]() i,Portfolio /

i,Portfolio / ![]() 2Portfolio

2Portfolio

Return Contribution: Product of Asset’s Weight and its Expected Return

weighti ∗ ![]() i

i

Sharpe Ratio: Ratio of Expected Return to Volatility

![]() i /

i / ![]() i

i

Note this is simply a “Return/Risk ratio,” which is not exactly the true definition of a Sharpe Ratio. However in the investment world vernacular the terms are interchangeable and for the purpose of this application their meanings are similar enough.

If you would like to know the precise definition of “Sharpe Ratio,” consult the source.

I created a slightly more elaborate version of this app in the Coursera course, Developing Data Products, the ninth of ten courses I took as part of the Johns Hopkins University Data Science certification.

Comments

One response to “Visualize Portfolio Risk”

[…] Visualize Portfolio Risk […]