When I accepted the Investment Section spot on the Society of Actuaries Annual Meeting planning committee, the first person I thought of to invite to speak was Eric Falkenstein.

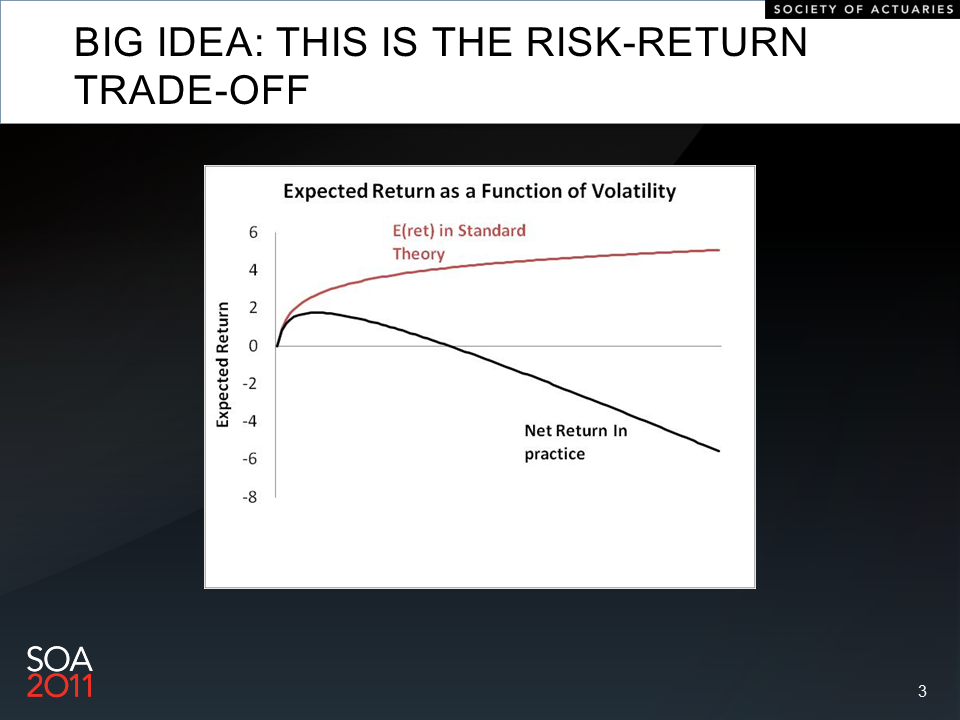

Eric Falkenstein is a quant, an author, and a blogger. He has a PhD in Finance from Northwestern University’s Kellogg School of Management. He has developed credit models at Moody’s, worked as an economist, and worked for and was inspired by the late Hyman Minsky. I’d been reading his blog, Falkenblog, for several years, and I had read his book, Finding Alpha. The book resonated with me professionally and personally. In it, Falkenstein advanced his view that the idea of a risk premium is a myth. (He is working on an updated book, btw.)

Forget About Greed – People (Investors) are Motivated by ENVY

While others have noted the problems with finding empirical evidence for the idea that risk and return are related – perhaps starting with Bob Haugen and Nardin Baker – few have spent as much effort as Falkenstein has coming up with an explanatory paradigm. While still evolving, his explanation depends on humans being less motivated by greed than they are by envy. Once you change an investor’s motivation from centering on absolute wealth to wealth relative to others, you change your concepts of risk. And you can explain a lot of investor behavior, particularly trend following and indexing.

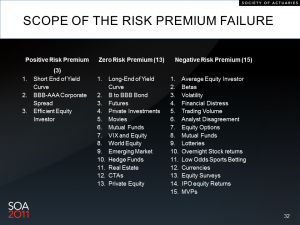

In his presentation to the SOA, “There Is No Risk Premium,” Falkenstein cited realized return examples in 31 asset classes: 3 with a positive risk premium, 13 with zero risk premium, and 15 with a negative premium.

Source: Eric Falkenstein

To orthodox financial academics either this is heretical or it confuses “expected” returns with “realized” returns. Falkenstein and I chuckled about the confusion objection; since there’s no empirical data for “expected” returns it’s really a non-falsifiable objection.

Epistemologist and Philosopher

A lot of investment professionals – whether in their newsletters or blogs – often stray off topic. They write as if they long to be regarded as not just great investors but also as clever wits. Few succeed. Those who don’t contrive their writing, trying too hard to signal that they’re erudite or well-rounded. I find much of it to be thinly veiled self congratulations.

In contrast I have found Falkenstein’s writing to be genuine. He’s a student of philosophy and especially of epistemology, but he tends to discuss those topics only to make a point. I have found his writing has explained much of what has puzzled me during my career – not just about investments but about people. What seems anomalous in a greedy paradigm suddenly makes sense when you view things through a lens of envy.

Thought provoking.