Many of this site’s visitors are interested in learning about risk parity, especially how to obtain risk parity weights using Excel. The PortfolioWizards Risk Parity Excel workbook is easily the most popular download on the site.

Recently a hedge fund manager contacted me who had been playing with the risk parity workbook. He asked whether it is possible to have a risk parity portfolio with short positions. The short answer is: sometimes.

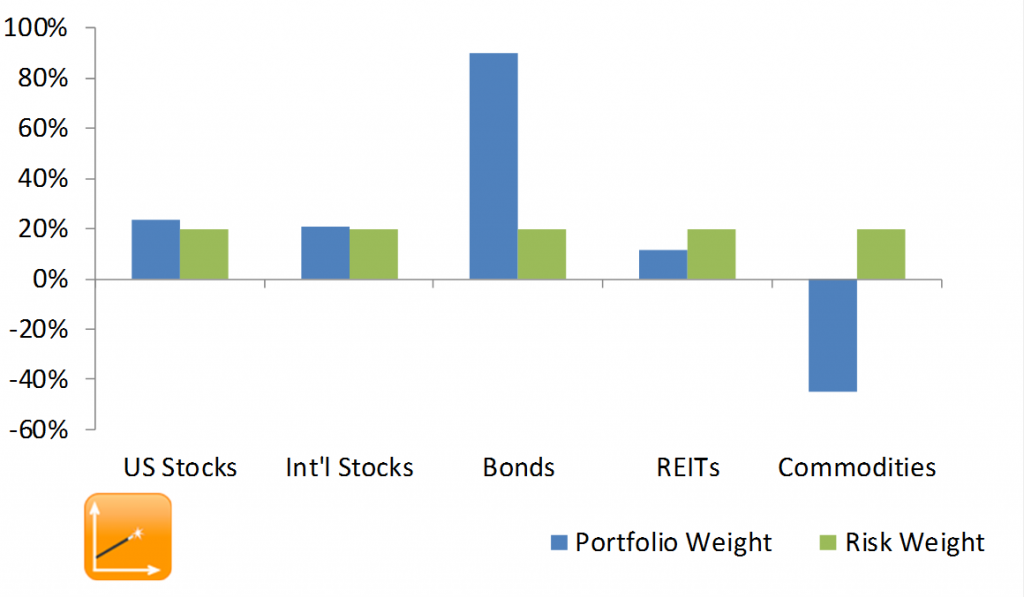

To test this idea I used the 5-asset risk parity workbook and altered its configuration. I wanted to allow one asset’s weight to be negative; this required I remove the constraint Weight>=0 and add a constraint that the weight be less than zero for the asset I wished to sell short. I was able to obtain risk parity portfolios with Commodities sold short, with REITs sold short, and with Bonds sold short. However I was unable to find risk parity allocations with either US Stocks or International Stocks sold short.

In order to obtain the respective results with short positions in either of Commodities, REITs, or Bonds, Solver did not find the weights without help. I had to play with the starting weights (especially for Bonds), giving Solver a hint.

NB: The out put from this workbook reflects its inputs, which I made up. Do not mistake them for forecasts or predictions. The numbers are intended as placeholders for your own assumptions. Do not rely on the numbers provided.

5-asset Risk Parity portfolio, Short Commodities

5-asset Risk Parity portfolio, Short REITs

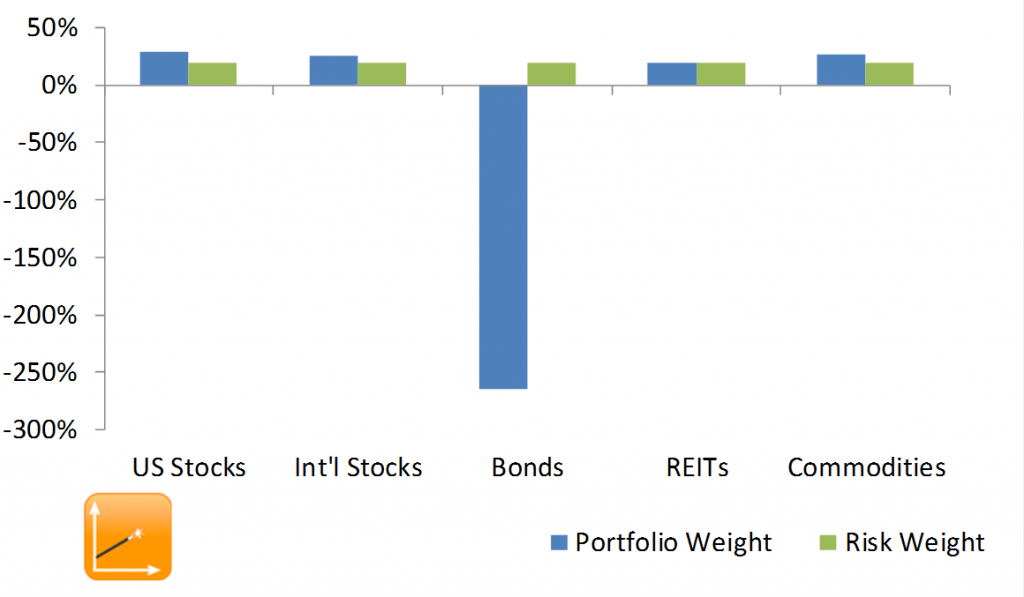

5-asset Risk Parity portfolio, Short Bonds

The “short bond” portfolio is long 100% risk assets and short nearly 300% bonds. Interestingly its allocation resembles a poor man’s 2x inverse of E-Trac’s risk-off ETN, OFF, short nearly 3x capital in Bonds and long everything else.

This does not prove risk parity solutions are always possible, never mind advisable

It really depends on your assumptions about your assets’ covariances. I populated the risk parity workbooks with fictitious data, including a correlation coefficient between US and International stocks of 0.95, which is really more of a “stress environment” correlation coefficient than a typical one. With a lower correlation coefficient between them, the possibility for a risk parity portfolio grows.

Caveat Venditor!

While this is a fun diversion, keep in mind that the distribution of returns for an asset sold short is quite different from that of an asset held long. A covariance alone is probably insufficient to capture the risk of a short position. A long position’s worst possible return is -100%; a short position’s is unlimited. It’s easy for inexperienced investors to dismiss that difference, but from a risk management perspective that difference is critical. Further, the dynamics of managing a portfolio with short positions feel backward. “Good” trades result in smaller and smaller positions, which means if you wish to adhere to your risk budget you have to sell short more and more. “Bad” trades grow position sizes, requiring you to buy (gulp) something that has risen in price in order to trim your position.